Introduction

In the apparel manufacturing industry, understanding the true cost structure of a single product is essential for maintaining margin control, optimizing supply chains, and making informed pricing decisions.

By dissecting each cost component, we uncover the hidden expenses that influence profitability, especially for brands operating in fast fashion, direct-to-consumer (DTC), or premium segments.

This granular view enables sourcing teams, product developers, and brand operators to improve cost planning, increase transparency with suppliers, and make strategic trade-offs between cost and value creation.

The Sweatshirt Cost Landscape

A 320gsm unisex hooded sweatshirt, commonly found across fashion categories, undergoes multiple stages before reaching the end consumer. From design and sampling to bulk production and distribution, each phase carries distinct costs that accumulate into the product’s final landed cost.

For clarity, we categorize these into three major buckets:

- Raw Materials: Includes the main fabric and all trims or accessories.

- Manufacturing Costs: Covers labor, processing, sampling loss, and packaging.

- External & Operational Costs: Encompasses logistics, tariffs, platform commissions, digital advertising, and after-sales risks.

To illustrate the cost variation across market positions, the chart below compares how each brand type—Fast Fashion, DTC, and Premium—allocates its budget across these components.

| Cost Component | Fast Fashion | DTC Brand | Premium Brand |

|---|---|---|---|

| Main Fabric | 24% | 32% | 38% |

| Labor & Manufacturing | 20% | 26% | 28% |

| Trims & Packaging | 8% | 8% | 6% |

| Post-Processing | 6% | 6% | 6% |

| Logistics & Duties | 14% | 10% | 8% |

| Platform Fees & Ads | 20% | 12% | 10% |

| Returns & Risk Provisions | 8% | 6% | 4% |

Raw Material Costs

Raw materials form the foundation of apparel cost structure, with the main fabric typically contributing the largest share. In sweatshirt production, even minor changes in fabric type, GSM (grams per square meter), or consumption rate can significantly impact total unit cost. Trims and accessories—though smaller in proportion—also play a key role in quality perception and compliance.

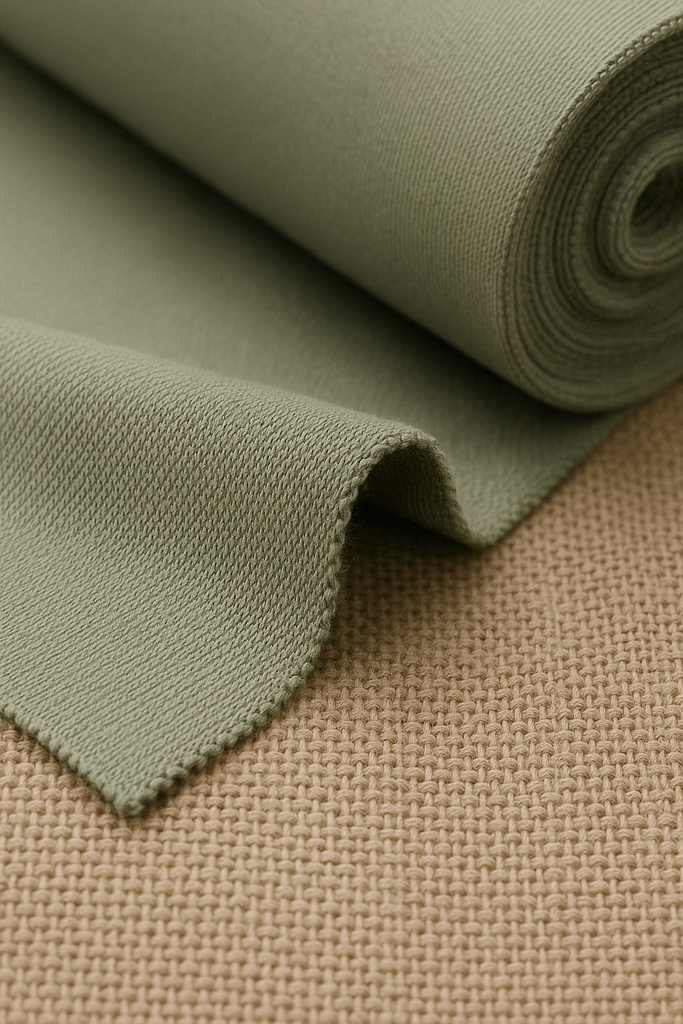

a. Main Fabric

The primary cost driver is calculated using the following formula:

Fabric Cost = GSM × Consumption (meters) × Price per Meter

Example:

For a 320gsm loopback terry fabric:320gsm × 1.6m × $2.20/m = $3.52 per unit

Influencing Factors:

- Fiber Composition: Cotton, recycled blends, or performance synthetics affect cost and MOQ.

- Knitting Method: Loopback, brushed fleece, or interlock options have different pricing.

- Source Region: Prices vary by country due to yarn price, energy cost, and mill scale.

Fabric cost accounts for 24–38% of total cost, with higher-quality brands often opting for custom-developed or certified fabrics at premium rates.

b. Trims & Accessories

These include functional and branding components such as:

- Zippers or buttons (if applicable)

- Drawcords

- Neck and wash labels

- Hangtags

- Care/instructional labels

Typical range: $0.50 – $0.80 per unit

Costs depend on quantity, print method, material (e.g., woven vs. printed labels), and compliance needs (e.g., REACH, CPSIA).

Efficient sourcing often involves trim standardization across SKUs to consolidate orders and reduce cost variance.

Manufacturing Costs

Manufacturing goes beyond simple sewing—it encompasses labor, equipment usage, production inefficiencies, and finishing work. These costs vary significantly depending on the garment’s complexity, production region, and operational scale.

a. Labor Costs

Labor is calculated using the SMV (Standard Minute Value) method:

Labor Cost = SMV × Labor Rate per Minute

Example:

For a basic hoodie with 16 minutes of sewing:16 min × $0.08/min = $1.28 per unit

For garments with intricate details—such as double-layered hoods, hidden pockets, or applique logos—SMV can increase to 25–30 minutes, pushing labor cost closer to $2.50 per unit.

b. Waste & Sampling Losses

Production waste and pre-production sampling costs are frequently overlooked. These include:

- Fabric Loss: Estimated at 3–5% for cutting errors, fabric defects, or QC rejects.

- Sample Development: Cost of proto, fit, PPK, and TOP samples amortized into bulk pricing.

Typical buffer: $0.10 – $0.30 per unit allocated to cover early-stage development.

c. Post-Processing

Post-processing ensures the product is sale-ready:

- Washing: For pre-shrinkage or hand-feel enhancement

- Drying & Steaming: To stabilize dimensions

- Final QC or Ironing: For presentation and inspection

Estimated range: $0.30 – $0.60 per unit depending on method and quantity.

d. Packaging

Final packing includes:

- Polybags (standard or biodegradable)

- Brand hangtags

- Barcode stickers

- Cartons (often calculated separately in logistics)

Typical cost: $0.30 – $0.50 per unit, depending on packing spec and automation level.

External and Operating Costs

- Logistics and Duties

- Costs vary by trade terms: EXW, FOB, CIF, DDP

- EXW: Buyer handles most shipping, lower upfront cost

- DDP: Seller handles all, higher unit cost but more convenient

- B2B shipping cheaper per unit (bulk), B2C shipping costlier (small parcels, last-mile delivery)

- Unit logistics cost ranges from cents (bulk) to several dollars (direct-to-consumer)

- Platform Commissions and Advertising

- Platforms (Amazon, Shopify, Tmall) charge 5–15% commission per sale

- Advertising costs add on top, total platform + ads often 10–25% of sale price

- Direct impact on unit profitability and pricing decisions

- Returns and Damage Risks

- Return rates affect cost allocation (e.g., 5% return on $20 unit = $1 cost per unit)

- Mitigation: strong quality control, clear customer guidance, transparent policies

- Reduces financial loss from returns and damaged goods

Implications for Brand Operators

- Strategic Pricing and Profit Control

- Understanding detailed cost breakdowns helps brands set competitive yet profitable prices.

- Brands can identify which cost drivers offer room for negotiation or optimization (e.g., raw materials vs. logistics).

- Cost transparency enables dynamic pricing adjustments in response to market changes or supply fluctuations.

- Product Design and Development

- Detailed cost insights inform design choices to balance aesthetics, functionality, and cost-effectiveness.

- Incorporating cost considerations early reduces expensive redesigns and over-specifications.

- Modular or standardized components can reduce manufacturing complexity and waste.

- Balancing Cost Efficiency with Brand Value

- High-end or luxury brands may prioritize premium materials and craftsmanship despite higher costs to maintain perceived value.

- Fast fashion brands focus on minimizing costs and lead times to maximize turnover.

- DTC brands benefit from direct customer feedback, allowing more precise cost-value trade-offs.

- Manufacturing and Supply Chain Decisions

- Brands must weigh local production (higher labor costs but faster response and quality control) against offshore manufacturing (lower costs, longer lead times).

- On-demand or small-batch production reduces inventory risk but may increase unit costs.

- Bulk production benefits from economies of scale but requires accurate demand forecasting.

- Leveraging Technology and Data

- Adoption of AI and data analytics can improve cost estimation, BOM (Bill of Materials) accuracy, and supply chain forecasting.

- Digital tools enable scenario planning to optimize production, logistics, and pricing strategies.

Conclusion

Cost transparency is a critical factor that extends beyond day-to-day operations to shape long-term strategic decisions for apparel brands. Understanding the full breakdown of sweatshirt costs—from raw materials and manufacturing to logistics and platform fees—enables brands to set competitive prices, control profits, and optimize product development.

Building a reliable internal cost database is a foundational step toward improving accuracy in cost management. As the industry evolves, adopting advanced tools such as dynamic cost accounting and AI-assisted BOM estimation will become increasingly important. These technologies help brands respond quickly to market changes, reduce waste, and enhance overall efficiency.

GOPHERWOOD specialize in flexible production models, including incoming material processing and commissioned design, to meet diverse brand needs worldwide. Partnering with our means gaining a reliable, quality-focused manufacturing ally committed to helping your brand thrive in a competitive global market.